Decrease cycle time, increase placement ratio, increase revenue!

Two metrics that dramatically improve

your business efficiency and increase revenue!

Cycle time

Cycle time is the number of days it takes for an application to go from submitted to placed (inforce.) The industry average cycle time is 70 days.

Placement ratio

Placement ratio is the percentage of your insurance policies that are placed inforce. The industry average is 75%.

These two metrics measure how efficient your business is. If you can decrease cycle time and increase placement ratio, you will minimize declines, increase client satisfaction and improve how quickly a client can be insured. Additionally, by decreasing cycle time and increasing placement ratio, you can increase revenue.

Example

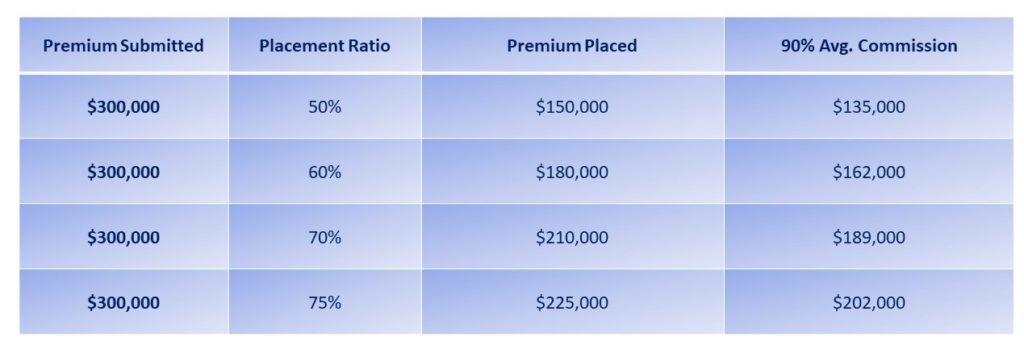

A 25% increase in placement ratio can lead to a 50% increase in revenue. If you submit $300,000 per year in life insurance premium, but your placement ratio is 50%, your revenue is $135,000. If your placement ratio was 75%, you increase your revenue by 50% or an additional $67,500 in annual revenue. (Assuming 90% average commission.)

Start decreasing cycle time and increasing placement ratio today:

- Before you run any quotes, start with a client needs analysis. The cheapest quote is not always the best fit. Find out things like your client’s financial needs, their health, their need for LTC or legacy planning. If you ask questions before you run and compare quotes, you can save time once the application is submitted.

- A little field underwriting goes a very long way. Even if you do not have all of your client’s health details, reviewing age, height, weight and some basic factors can start to narrow your search.

- Start with an informal application. Use our informal process to gather client information, then let our underwriters review and narrow the scope of products. This step will minimize cycle time and increase the likelihood of placement.

- Consider accelerated underwriting. Some products will provide an approval in less than 10 minutes. If your clients qualify, approval is almost instantaneous.

- Use Docusign, eApps and eDelivery. These tools will improve your cycle time up to 80%. eApps can go from submitted to placed within 24 hours. Not every case moves this quickly, but they can.

Final notes…

If you haven’t considered annuities in your practice, you may want to think about how they will supplement your revenue. Annuities have an almost 100% placement ratio and can diversify your product and revenue mix.